social.outsourcedmath.com

Luke 21:4 wrote:

For they have put in a little of the money they had no need for. She is very poor and has put in all she had. She has put in what she needed for her own living.

A Woman Whose Husband Had Died Gave All She Had - Jesus looked up and saw rich men putting their money into the money box in the house of God. He saw a poor woman whose husband had died. She put in two very small pieces of money.Bible Gateway

Do we have to say it again? The virus is the economy. For daily updates on the coronavirus pandemic and the economy, subscribe to Sake Me Smart.www.marketplace.org

Mark Twain wrote:

There are three kinds of lies:…, statistics are at least a double-edged sword.

lies, damned lies and statistics.

AbeBooks.com: how to Lie with Statistics: Creased cover. We are a family business, and your satisfaction is our goal!www.abebooks.com

The video is horrific, and the brutality is stark. But that was the case in Ferguson, Mo., in 2014 and Minnesota in 2016.www.npr.org

The Police Use of Force Project investigates how police use of force policies can help to end police violence.useofforceproject.org

Eddie Izzard wrote:

Pol Pot killed 1.7 million people. We can't even deal with that! You know, we think if somebody kills someone, that's murder, you go to prison. You kill 10 people, you go to Texas, they hit you with a brick, that's what they do. 20 people, you go to a hospital, they look through a small window at you forever. And over that, we can't deal with it, you know?(Link to quote source)Someone's killed 100,000 people. We're almost going, "Well done!

You killed 100,000 people? You must get up very early in the morning. I can't even get down the gym! Your diary must look odd: “Get up in the morning, death, death, death, death, death, death, death – lunch- death, death, death -afternoon tea - death, death, death - quick shower…"

The NYSE constructed a pair of antennas on the roof of its data center that transmits two-millionths of a second faster than private firms'.www.marketplace.org

If you want to know what's going on in this economy, the bond market is a pretty good place to start.www.marketplace.org

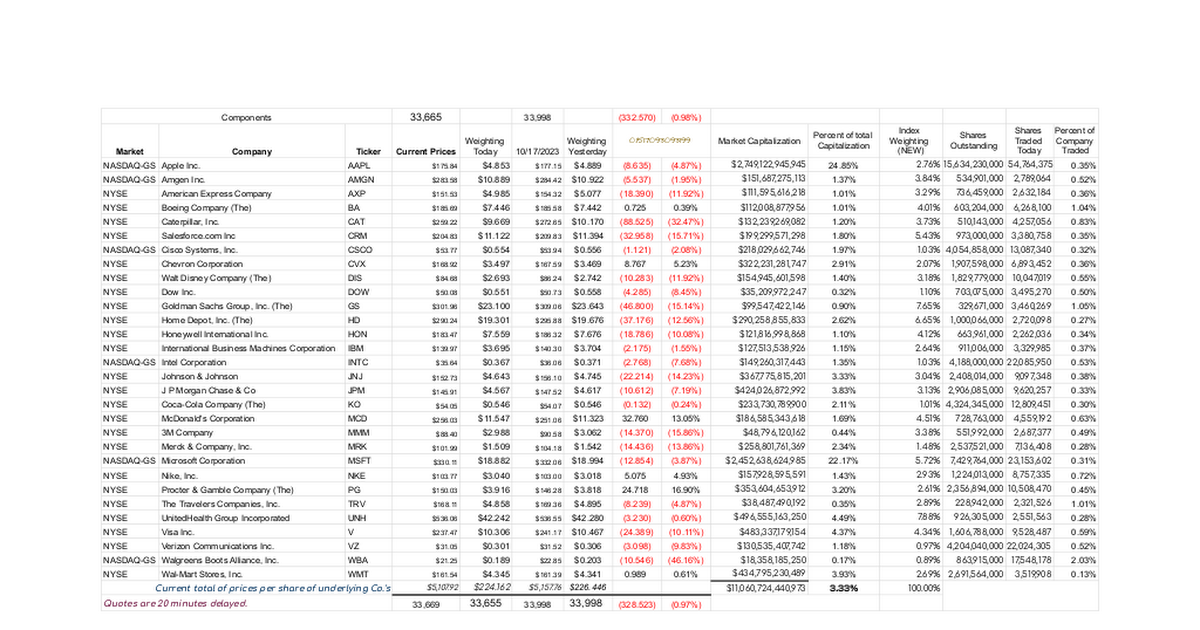

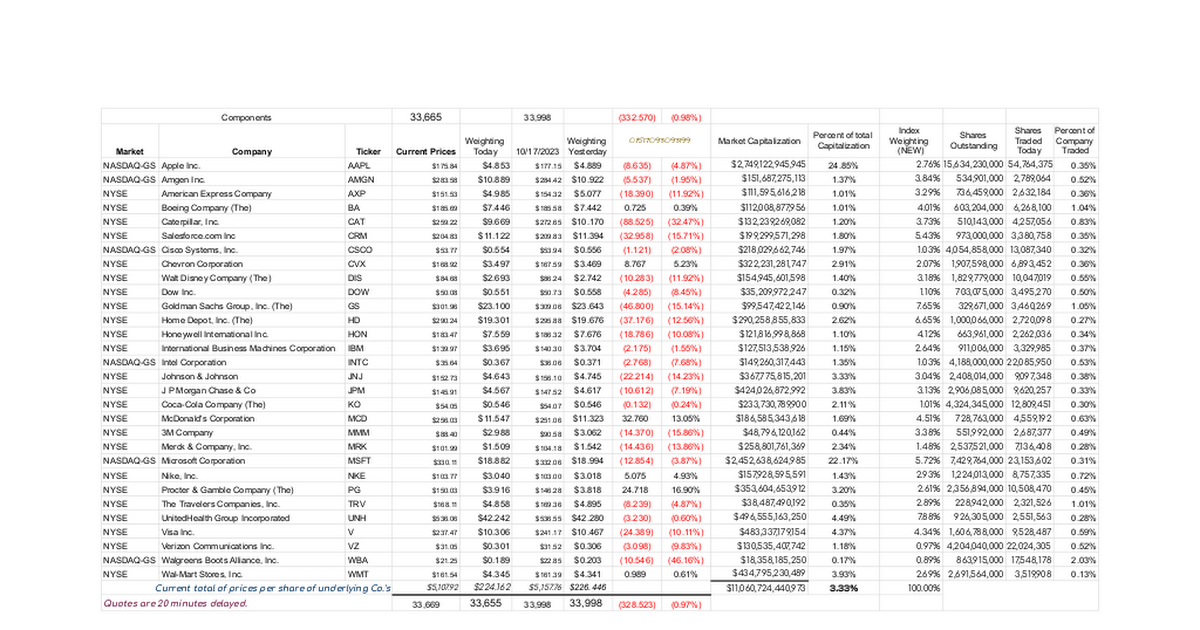

DJI Components,$26,950,$26,935.07,14.920 ,0.06% Market,Company,Ticker,Current Prices,9/22/2019,0.1483289258205 NYSE,3M Company,MMM,$166.76,$166.94,(1.214),(0.73%) NYSE,American Express Company,AXP,$118.24,$116.80,9.708 ,8.31% NASDAQ-GS,Apple Inc.,AAPL,$218.72,$217.73,6.674 ,3.07% NYSE,Caterpill...docs.google.com

The stock market is not the economy … so what is it?

But, yes, the two are related. And that relationship can get pretty interesting.www.marketplace.org

INX Components,3,000.060,2,995.990,4.070 ,0.14% Market,Company,Ticker,Current Prices,Base Cap Factor,10/22/2019,Base Cap Factor Prior Day,8,649,364,525 ,Market Capitalization,Percent of total Capitalization,Shares Outstanding,Shares Traded Today,Percent of Company Traded NYSE,3M Company,MMM,$167.53docs.google.com

DJI Components,$26,950,$26,935.07,14.920 ,0.06% Market,Company,Ticker,Current Prices,9/22/2019,0.1483289258205 NYSE,3M Company,MMM,$166.76,$166.94,(1.214),(0.73%) NYSE,American Express Company,AXP,$118.24,$116.80,9.708 ,8.31% NASDAQ-GS,Apple Inc.,AAPL,$218.72,$217.73,6.674 ,3.07% NYSE,Caterpill...docs.google.com

Today on the show, we ignore the advice of some very smart people and bet against something people love.www.npr.org

July 8, 2019Play EpisodeA family-owned business fights a billion-dollar, multinational company. And wins.You can follow Spectacular Failures on Twitter and Facebook using @failureshow. We're @failure_show on Instagram. Follow Lauren Ober on Twitter and Instagram at @oberandout.BizWiz Link:Building Relationships and Improving Opportunities!�...www.spectacularfailures.org

The #Democratic #Debates are going to feel like a long weekend with the whole extended family: grandfather figures banging the table, no-nonsense women in the clan taking the old guys to task; up-start kids you ...